Weekly reading 6

May 04, 2020- Apple

- uber

- sweetgreen

- finance

- FB

- covid19

More on Apple and Google, Germany Versus Apple, Facebook’s Surveys - stratechery:

We recently started showing the Facebook community in the United States an opt-in symptom survey run by health researchers at Carnegie Mellon University. The survey asked people if they have symptoms such as fevers, coughing, shortness of breath or loss of smell that are associated with COVID-19.

That’s a new angle, treating FB as a large scale crowdsourcing platform.

Chinese internet users who uploaded coronavirus memories to GitHub have been arrested - qz:

I actually visited the other site mentioned in the post, but it’s now 404 in github.

Trump to Order U.S. Meat Plants to Stay Open Amid Pandemic - bloomberg:

President Donald Trump signed an executive order Tuesday that compels slaughterhouses to remain open, setting up a showdown between the giant companies that produce America’s meat and the unions and activists who want to protect workers in a pandemic.

Again for comparison, China has shutdown everything. Where did meat in China come from you say? Lots of neighborhoods put a restriction to their residents in terms of food consumption. To do this, many neighborhood centralized the purchase of grocery for all the residents, and controlled their consumption of food by controlling the distribution. It is difficult to say which way is better.

Sweetgreen: Nicolas Jammet and Jonathan Neman - npr:

The first sweetgreen store numbers: 500 sqt, 3k monthly rent, 350k quote for construction, pitched 250 people, raised 300k from 50 of them. Turned profit in first couple months.

Nomura: Only Machines Are Buying Stocks As Humans Stay At Home - zerohedge:

This sort of explains why stocks are rising while everything else is tanking. Although if humans are scared of buying, why do bots still do? I thought algorithms are smart enough to tell the pattern.

Uber Discusses Plan to Lay Off About 20% of Employees - theinformation:

To be fair layoff is welcomed by investors as part of cost cutting, so expect Uber stock to rise.

U.S. Economy Shrinks at 4.8% Pace, Signaling Start of Recession - bloomberg:

But not big enough to stop the soaring stock market.

It’s a Good Time to Cut Dividends - bloomberg:

In ordinary times, if you cut your dividend it means that you did something bad. Now, if you cut your dividend, it doesn’t mean that you did something bad. It doesn’t mean that you didn’t! It doesn’t mean anything. Good smart prudent companies are cutting their dividends now, everyone is cutting their dividends, which means that if you are a dumb bad company it’s a great time to cut your dividend.

If You’re Bored You Can Trade Stocks - bloomberg:

Retail investors are not trading because they have an informational advantage and a reasonable expectation of profit. They are trading because it is fun, or because it looks fun. They see people making money in the stock market, it looks fun and easy to make money in the stock market, they start trading stocks. As long as it is fun—as long as stocks going up—they increase their investments. When it stops being fun—when stocks go down—they get out.

It argues that more retail investors start treading out of boredom. This makes sense, also when market is volatile it is more appealing for investors as they dream about profiting in the volatility.

Would this explain the recent surge of stock market? A [2009 study] says retail investors are only account for 30% trading volumes in the market. So maybe not.

Apple’s first coronavirus-impacted quarter isn’t great but it’s not terrible either - macworld:

Here’s how the product lines break down:

iPhone: Down 7. 5 percent from $31B to $28.9B iPad: Down 10 percent from $4.9B to $4.4B Mac: Down less than 3 percent from $5.5B to $5.35 billion Wearables: Up 22 percent from $5.1B to $6.3B Services: Up 17 percent from $11.5B to $13.4B

Wearables are watches and AirPods. It is impressive to see they grow to be the 3rd largest revenue streams within just a few years. Especially the AirPods: what we realize is when reporters are doing news at home, almost all of them wear AirPods. It pairs to all the product lines listed there.

Who’d have thought the most ubiquitous wearable is earphone? In the future it will only get more and more functions - it already starts to have its own chip (AirPods Pro).

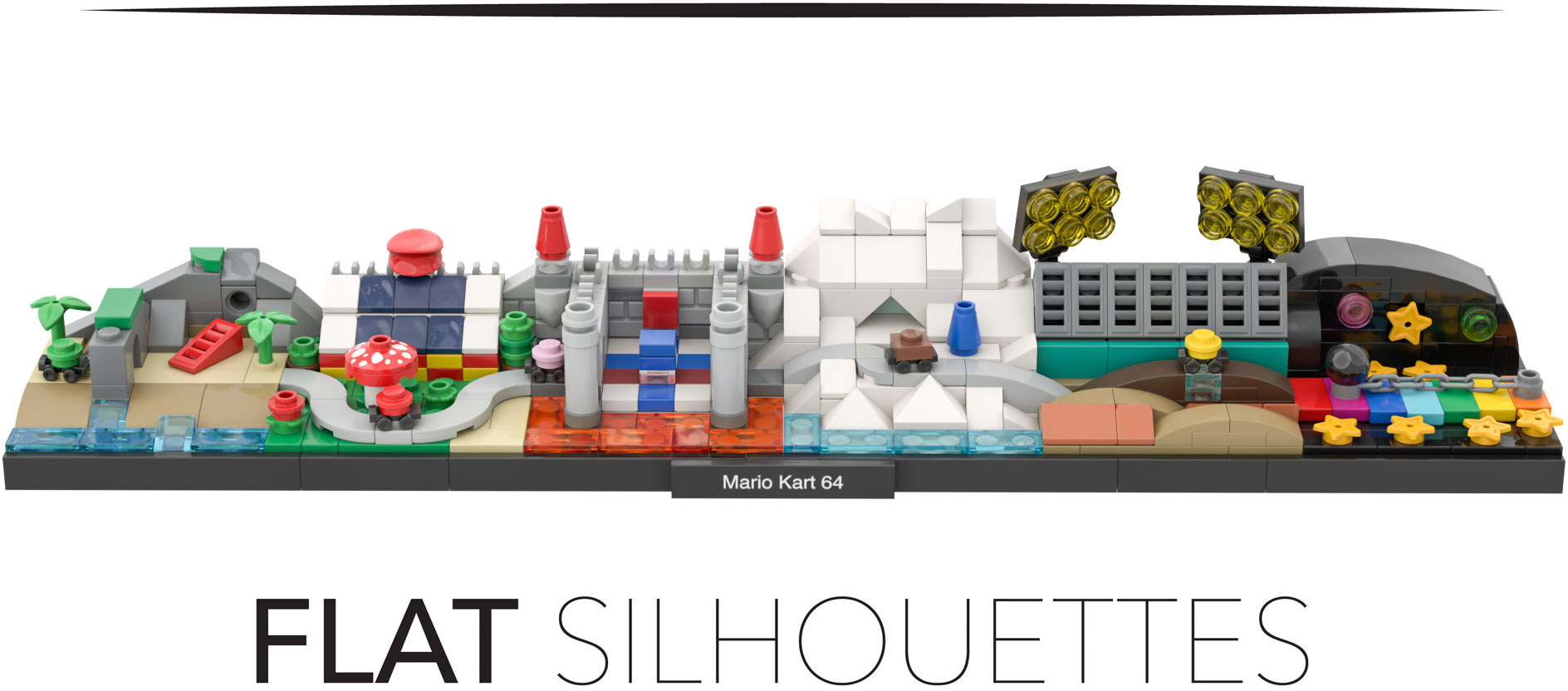

Designing Skylines - brickset:

This is a user-created skyline mock of Mario Kart. Skyline series has so much potential. Although licensing could be an issue for LEGO to start doing something like this.

Rare minifigures - brickset:

LEGO offers internally mini figure as business card for its employee. This is actually a pretty boring design. The only value is scarcity. While I don’t work there, LEGO should offer one-time for every employee to design their own mini figure, not just print name on the shirt.

Apple Q2 2020 results: $58B revenue, but no guidance - sixcolors:

More Apple revenue, in charts. This growth of service revenue is just impressive, so consistent.

Other reads:

- Help for PRC students overseas; US-China truce?; Luckin blows up; Discourse power and propaganda struggle - sinocism

- No cases in Wuhan; 20%+ unemployment?; Oil mess; Tech execs behaving badly - sinocism

- Huawei employees sue company after police detention - ft

- Jeffrey Gundlach: We Will Take out the March Lows - thesoundingline

- On the Prospect of a Depression - thesoundingline

- David Rosenberg: Stagflation Coming, But It’s a Few Years Out - thesoundingline

- Fed Prints Another $205 Billion This Week, M2 Growing at Fastest Pace on Record - thesoundingline

- Ray Dalio: We’re Headed for a Completely New World Order - thesoundingline

- Killing Me Softly : the Power Pandemic : The Little Red Podcast - omny

- Google Revenue Climbs, but Company Warns of ‘Tale of Two Quarters’ - wsj

- The Anti-Amazon Alliance - stratechery

- Uber discusses plan to lay off about 20% of employees - ycombinator

- 刷屏的成都东部新区,你读懂了多少? - qq

- Oil Traders Not Sure They Like Oil - bloomberg

- Shopify Shop, Shopify’s Reason to Exist, Google’s Earnings - stratechery

- Facebook Earnings, Auction Dynamics, Full Steam Ahead - stratechery

- WSB Lately - reddit

- Spending shifts at Chewy and Rover as pet owners stay home in pandemic - secondmeasure

- Accountability and reparations; Virus origins; More propaganda attacks on Pompeo; BRI debt relief - sinocism

- Friday open thread-Three questions and a little Kim - sinocism

- It Doesn’t Pay to Be Too Ethical - bloomberg

- Apple’s pandemic stars: Mac, iPad, and its big pile of cash - macworld

- Designing Skylines, part 2 - brickset

- LEGO Collectable Minifigures 71027 LEGO Minifigures - Series 20 - Complete review - brickset

- LEGO Collectable Minifigures 71027 LEGO Minifigures - Series 20 - Complete review - brickset

- A trio of classic cars - brickset

- This is Tim: Transcript of Apple’s Q2 2020 financial call - sixcolors